Accounting Which Journals Are Used for Receipt on Account

Ruled lines and columns help keep your calculations neat and easy to read. A sales invoice is prepared in duplicate.

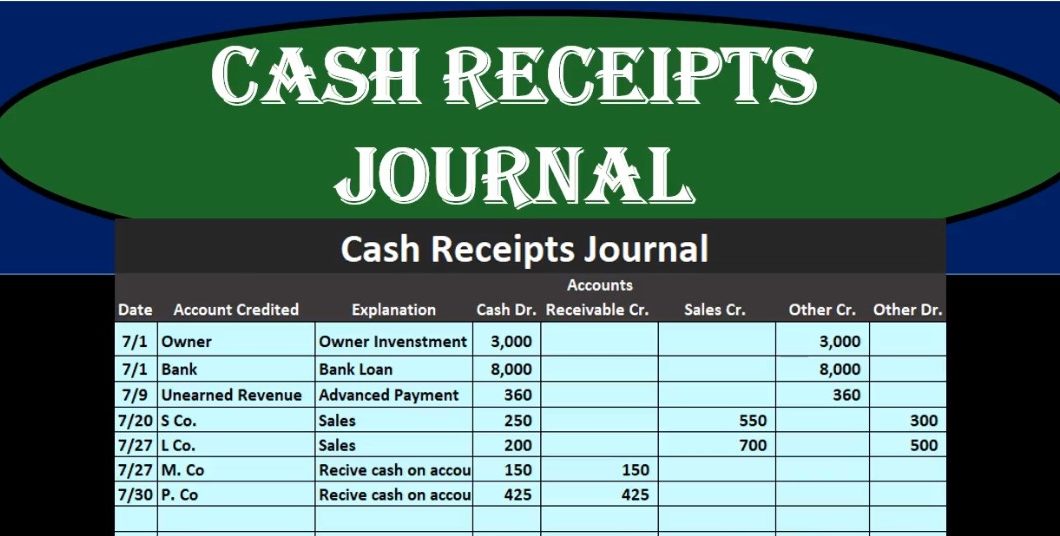

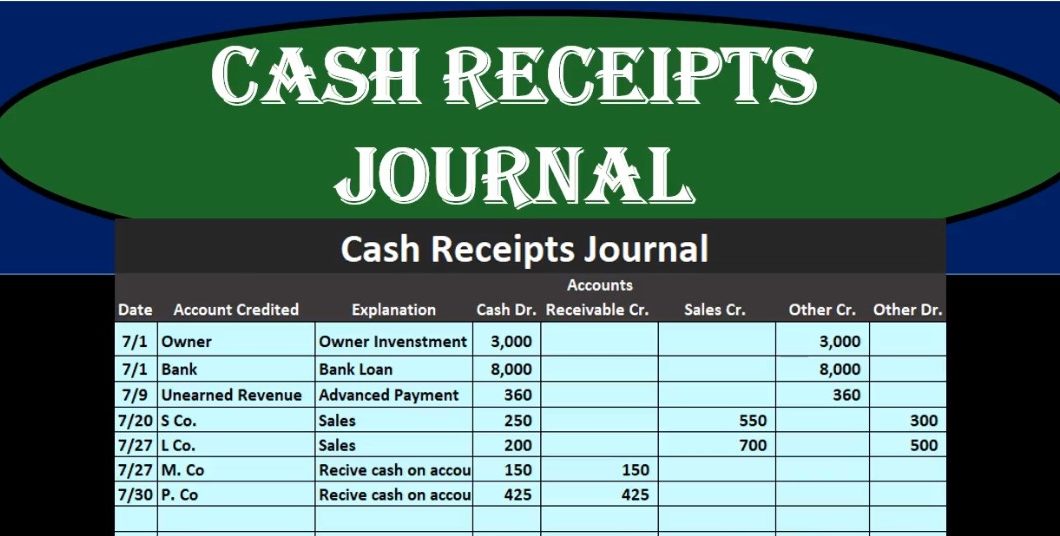

What Is Cash Receipts Journal Cash Payment Journal

The copy is used as the source document for the sale on account transactionCONCEPT.

. The specialty journals are Sales Journals Purchase Journals Cash Disbursement Journal and Cash Receipt Journal. In reality journals are used by accountants to work directly with the general ledger to create both debit and credit entries for unique financial transactions. For example if you are purchasing goods from Supplier A for a value of Rs.

Consider using check registers to record. Click on F9Purchase on the Button Bar or press F9. An invoice used as a source document for recording a sale on account is called a A sales invoice is also referred to as a sales ticket or a sales slip.

The journal entries are recorded in chronological order. Taking care of your office finances and bookkeeping needs has never been as easy with accounting books which can be used in place of software or alongside accounting software programs to help you balance company budgets and oversee expenses. The original copy is given to the customer.

Go to Gateway of Tally Accounting Vouchers. Recording a Purchase Entry When a company buys goods on credit or cash Purchase voucher is used to record all the Purchase transactions of the company.

Cash Receipts Journal 40 Accounting Instruction Help How To Financial Managerial

Comments

Post a Comment